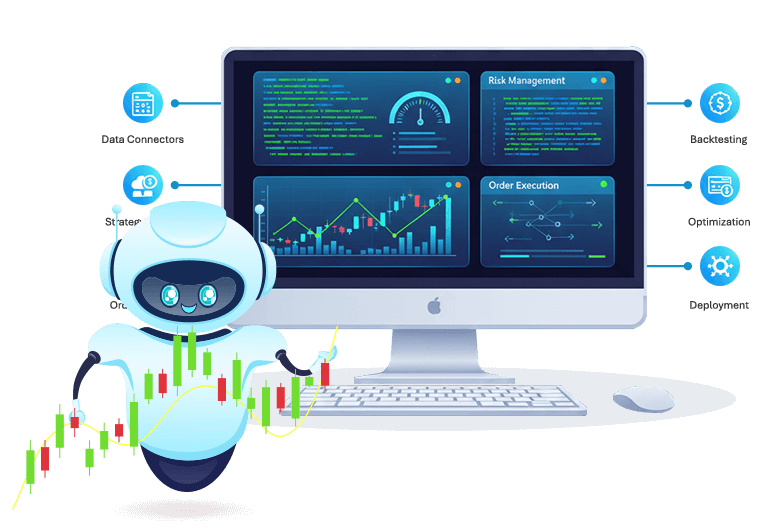

Our Algorithmic Trading Software Development Services

Explore Algo Trading & FinTech Services

Strategy Development & Backtesting Platforms

Our algorithmic trading software developer, engineers quantitative research environments with multi-asset backtesting engines, advanced statistical libraries and tick-level simulation to validate trading strategies under real market conditions.

Real-Time Trading Engine Development

Our low-latency trading engines execute stock trades, options, futures and forex within microseconds using smart order routing and event-driven architectures.

Risk Management System Integration

We embed real-time risk analytics, automated stop-loss/limit checks and VaR/stress-testing models into trading workflows, ensuring continuous risk visibility and regulatory adherence.

Market Data Infrastructure Development

We design high-throughput data pipelines that ingest, normalize and distribute feeds from exchanges and data vendors, with in-memory caching for ultra-fast access and historical tick data management.

Portfolio Management System Integration

Our integrations enable position-level reconciliation, P&L attribution and API-driven data exchange between trading engines and portfolio management systems for end-to-end investment oversight.

Compliance & Regulatory Reporting Tools

We provide real-time trade surveillance modules, algorithmic audit trails and automated MiFID II/SEBI/Dodd-Frank reporting engines to maintain compliance across jurisdictions.

Cloud Infrastructure & DevOps

We deploy trading platforms with containerized microservices, CI/CD pipelines, auto-scaling clusters and Kubernetes orchestration ensuring fault-tolerant and highly available trading operations.

Build Your Algo Trading Solution

Whether you are a trader, hedge fund, or fintech startup, our team helps you design, develop, and deploy intelligent algo trading solutions. Book your consultation today and build smarter trading possibilities for long-term success

Start Building Algo Trading SoftwareWho Should Use Algorithmic Trading Software?

Algorithmic trading is no longer the exclusive domain of large financial institutions. While it is widely used by investment banks, hedge funds and mutual funds, it is also becoming accessible to a broader audience. Our services are customized for:

Quantitative Hedge Funds and Institutional Investors

For large-scale operations that require the execution of high-volume strategies and the management of extensive portfolios.

Proprietary Trading Firms

To gain a competitive edge by exploiting market inefficiencies with speed and precision.

Individual Traders

For those with the technical and financial skills to design and implement their own strategies, seeking to automate their operations and remove emotional bias.

FinTech Startups

Companies looking to build and commercialize their own trading platforms or to offer automated trading services to their clients.

Our Flexible Engagement Models

We understand that every trading project has unique requirements. Hence, we offer flexible engagement models:

Dedicated Development Team

A team of our expert algo trading software developers, QA and project managers works exclusively on your project, giving you full control and transparency.

Fixed-Price Model

Hire algo trading software developers for projects with well-defined scope and timelines. We provide a clear roadmap, milestones and deliverables at a predetermined cost.

Time & Material Model

Ideal for projects with evolving requirements. You can hire stock market software developers or pay only for the actual time and resources used, giving you flexibility and agility.

Benefits of Automated/Algo Trading Software Development

Competitive Edge:

Custom algorithms provide unique market advantages while keeping your proprietary strategies confidential.Optimized Performance:

Tailored to your asset classes, trading style, and risk profile for superior execution speed and accuracy.Scalability & Flexibility:

Built to scale with evolving markets, regulations, and technologies without disruption.Seamless Integration:

Robust APIs ensure smooth connectivity with existing infrastructure, risk systems, and third-party tools.Regulatory Compliance:

Compliance-ready stock trading app development with monitoring and reporting aligned to SEBI, MiFID II, and other global standards.Cost Efficiency:

No licensing fees or vendor lock-ins—achieve long-term ROI as trading volumes grow.Proven Expertise:

Extensive experience in stock market software development ensures high-performance, reliable systems.

Our Happy Customers

Talk to usSalvatore

Project Manager

“Infomaze is the best technology partner any business could ask for, they go above and beyond to satisfy my business needs and they will do research and develop anything you need. I will never switch to any other company, may your success be our success! P.S. Gaj is the best.”

Bryce

Project Manager

“Vic and the team at Infomaze are absolutely awesome to work with. Their price was fair and their professionalism is top notch. They spent more time waiting on me than I did them, and they were patient and courteous every step of the way. I would definitely recommend hiring them , and I will continue to use them for my future projects”

Jonathan

Project Manager

“I was very happy with the promises made and, more importantly, delivered. Quality code. Neat and organized. Ace assisted with the last tweaks to ensure I was a happy client. I would be happy to work with them again on my next project.”

Gerhard

Project Manager

“The project thus far was not complicated and we are continuing to the next phase. My experience with Vik to date: Very good service – friendly and helpful with” high level of technical understanding and competence. Listens to what I want, makes suggestions where appropriate and delivers very quickly.

Frequently Asked Questions

At Infomaze, our development timelines usually range from 8–20 weeks, depending on system complexity, integrations and compliance requirements.

Yes. Infomaze specializes in multi-broker and exchange connectivity. We support FIX protocol, REST APIs, WebSockets and have successfully integrated with platforms like Interactive Brokers, Zerodha, Alpaca and TD Ameritrade, among others.

Absolutely. Our trading platform software development provides ongoing monitoring, bug fixes, performance optimization and strategy fine-tuning to ensure your trading platform remains future-ready and competitive.

Yes. Our algorithmic trading software developer builds compliance into the architecture itself. Our platforms feature audit logs, automated reporting and monitoring tools to reduce regulatory risks and streamline audits.

Yes. We follow a modular and scalable development approach. This allows individual traders and fintech startups to start with core features at an affordable cost and expand as trading volumes and requirements grow.